How I Tamed My Fitness Spending and Built Real Financial Strength

We all want to stay healthy, but gym memberships, workout gear, and fitness classes can quietly drain your wallet. I learned this the hard way—spending big on trends that didn’t last. Over time, I discovered smarter ways to manage fitness expenses without sacrificing results. It’s not about cutting corners; it’s about building financial skills that align with your lifestyle. This is how I turned overspending into long-term control. What began as a personal struggle with recurring charges and underused memberships became a journey of financial clarity. By rethinking how I approached fitness spending, I gained more than just physical strength—I developed lasting financial discipline that improved every part of my budget.

The Hidden Cost of Looking Fit

Fitness is often marketed as a path to wellness, but behind the sleek studios and branded activewear lies a web of recurring expenses that can quietly erode financial stability. Many people don’t realize how fast these costs accumulate because they appear small in isolation. A $30 spin class here, a $60 monthly protein subscription there—these charges blend into the background of everyday spending. Yet, over time, they add up to hundreds, even thousands, of dollars each year. The danger lies not in any single purchase, but in the pattern of habitual spending without clear returns. Premium gym memberships, for instance, often come with high initiation fees and long-term contracts, locking users into payments regardless of attendance. Boutique studios offering specialized workouts—like aerial yoga, infrared saunas, or high-intensity interval training—charge premium rates, banking on the allure of exclusivity and results. While some find real value in these services, many others pay for access they rarely use.

The problem is compounded by the way fitness expenses are psychologically framed. Unlike luxury purchases, which are often scrutinized, fitness spending is seen as an investment in health—a justification that makes it easier to overlook inefficiencies. This mindset allows companies to position their offerings as essential, even when alternatives exist at a fraction of the cost. Consider the rise of wearable fitness trackers. While useful for some, many users stop wearing them within months, yet continue paying for connected apps or subscription-based coaching features. Similarly, specialty supplements like collagen powders, adaptogens, or fat burners are heavily advertised with bold claims, but their actual impact on fitness outcomes is often minimal. Consumers end up funding marketing campaigns rather than measurable improvements in strength or endurance.

Another overlooked aspect is the cost of convenience. Home delivery of workout meals, on-demand virtual classes with celebrity trainers, and personal training sessions—all offer time savings and personalized experiences, but at a steep price. For busy individuals, especially those managing households and careers, the appeal of convenience is strong. However, convenience-driven spending can become a habit that drains resources without delivering proportional benefits. The key is recognizing that not all fitness costs are equal. Some deliver consistent, measurable results, while others provide fleeting motivation or social validation. Without tracking actual usage and outcomes, it’s easy to fall into the trap of spending more for the appearance of commitment rather than real progress.

Why Fitness Spending Feels Justified (But Often Isn’t)

The emotional appeal of fitness spending makes it uniquely resistant to budget scrutiny. When someone buys a new set of resistance bands or signs up for a month of Pilates, they’re not just purchasing a service—they’re investing in a better version of themselves. This sense of moral virtue creates a powerful psychological shield against financial accountability. Because fitness is tied to self-worth, discipline, and long-term health, people often feel entitled to spend without guilt. This phenomenon, known as moral licensing, allows individuals to justify indulgences—like expensive gear or premium classes—because they believe they’re already doing something good. The logic goes: ‘I’m taking care of my health, so I deserve this upgrade.’ But this reasoning can lead to overspending on items that offer little functional benefit.

Marketing strategies amplify this effect by linking fitness products to identity and success. Advertisements rarely focus on the technical aspects of a treadmill or the nutritional content of a shake. Instead, they sell transformation—confidence, energy, control. These emotional promises make it harder to evaluate fitness purchases objectively. A $200 pair of designer leggings may perform no better than a $40 alternative, but the branding suggests exclusivity and achievement. Similarly, boutique fitness studios often cultivate a community atmosphere, where members feel a sense of belonging. This social reinforcement increases loyalty and reduces price sensitivity, making people less likely to question whether the cost matches the value.

Another factor is the immediacy of emotional reward versus delayed physical results. Signing up for a new program triggers a burst of motivation and optimism—the feeling that change is imminent. This emotional high can be mistaken for progress, even if actual workouts remain inconsistent. Over time, this cycle repeats: a new purchase brings temporary excitement, followed by waning engagement, then another purchase to reignite motivation. The financial cost mounts, but the physical results lag behind. Without awareness, this pattern becomes a form of financial leakage—money flowing out in pursuit of a feeling rather than a sustainable routine. Recognizing this disconnect is the first step toward breaking the cycle. By separating emotional satisfaction from tangible outcomes, individuals can make more rational decisions about where to allocate their fitness budget.

Tracking What You Actually Use

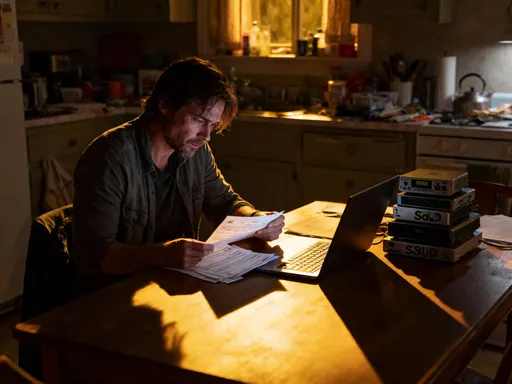

Before making any changes, it’s essential to gain a clear picture of current spending and usage. Most people have only a vague sense of how much they spend on fitness, let alone how often they use what they’ve paid for. The solution begins with a simple but powerful step: conducting a fitness spending audit. This involves gathering all recent bank statements, subscription records, and receipts related to fitness—everything from gym dues to online class platforms, apparel purchases, and supplement deliveries. Once compiled, these expenses should be categorized and totaled over a three- to six-month period to reveal the full scope of outflows.

Equally important is measuring actual usage. A gym membership may cost $80 a month, but if it’s used only four times, the effective cost per visit rises to $20—far above the value of a single drop-in pass. The same applies to digital subscriptions. How many of those on-demand workouts were actually completed? Did the meditation app reduce stress, or was it opened once and forgotten? For physical products, consider how often they’re used. That set of dumbbells gathering dust in the corner represents a sunk cost with no return. The goal is not to induce guilt, but to create awareness. By aligning spending with real-world behavior, individuals can identify mismatches between investment and utility.

This process often reveals surprising insights. One woman discovered she had spent $420 on a yoga studio package but attended only seven sessions—less than one per month. Another found that her $15 monthly fitness app subscription had been inactive for four months, yet the charge continued. These examples highlight the importance of regular review. Unlike utility bills, which provide consistent value, fitness expenses are highly variable in their return. Without active monitoring, it’s easy to keep paying for services that no longer serve their purpose. Tracking usage also helps identify what truly works. If outdoor walks deliver the same energy boost as expensive classes, that insight can guide future decisions. The audit isn’t about cutting everything—it’s about making intentional choices based on evidence, not emotion.

Building a Smarter Fitness Budget

With a clear understanding of past spending and usage, the next step is to create a realistic and sustainable fitness budget. This isn’t about deprivation, but about alignment—matching financial input with actual lifestyle needs and goals. A useful framework is the fitness value ratio: the relationship between cost, frequency of use, and personal benefit. A high-value activity is one that is both affordable and consistently used, delivering noticeable improvements in strength, endurance, or mental well-being. Low-value spending, on the other hand, involves high costs with infrequent use or minimal results.

To apply this, start by defining your fitness priorities. Is the goal weight management, stress relief, strength building, or social connection? Each objective may require different resources. For example, someone seeking stress reduction might find greater value in a low-cost walking routine or a library-based meditation guide than in a $200 monthly mindfulness retreat. Once goals are clear, allocate a monthly budget based on income and financial commitments. A common guideline is to limit discretionary spending—including fitness—to 5–10% of net income, but this should be adjusted to individual circumstances. The key is consistency. A $30 monthly investment used regularly is more valuable than a $100 monthly plan used sporadically.

Flexibility is also important. Life changes—seasons shift, schedules evolve, interests fluctuate. A rigid budget can lead to frustration and abandonment. Instead, build in room for occasional splurges, like a weekend wellness workshop or a new pair of running shoes, as long as they fit within the overall plan. Automating savings for these expenses can prevent impulse spending. Additionally, consider timing. Many gyms offer discounts in January and September, while outdoor programs are often free in summer. Aligning spending with seasonal opportunities can stretch the budget further. Ultimately, a smart fitness budget is not just about numbers—it’s about creating a system that supports long-term health without financial strain.

Alternatives That Deliver Results Without the Price Tag

Effective fitness does not require expensive memberships or cutting-edge equipment. In fact, some of the most sustainable routines are also the most affordable. Bodyweight exercises like squats, lunges, and push-ups require no gear and can be done anywhere. Walking, jogging, and cycling are proven cardiovascular activities that cost nothing beyond basic footwear. Public parks often feature outdoor fitness stations, and many communities offer free or low-cost group activities such as tai chi, Zumba, or boot camps. These options not only reduce expenses but also increase accessibility, allowing more people to participate regardless of income level.

Digital resources have also transformed the fitness landscape. While premium apps exist, many high-quality workouts are available for free on reputable platforms. National health organizations, public television, and university extension programs often provide science-based exercise videos at no cost. Libraries offer access to fitness DVDs and online learning portals, sometimes including streaming services with guided routines. Even YouTube hosts countless certified trainers offering structured programs—from beginner yoga to advanced strength training—without subscription fees. The key is consistency, not cost. Studies show that regular, moderate activity delivers greater health benefits than sporadic, high-intensity efforts, regardless of where they take place.

Home equipment can be a worthwhile investment if used regularly, but it’s important to assess needs realistically. A single set of adjustable dumbbells or a resistance band kit can support a full-body workout for years at a fraction of gym costs. However, large machines like treadmills or ellipticals often end up underused due to space constraints and maintenance issues. Before purchasing, consider trial periods or secondhand options. Many communities have buy-nothing groups or resale platforms where lightly used gear can be acquired for minimal cost. The focus should be on functionality, not features. A simple mat and a timer can support a highly effective routine. By prioritizing practicality over prestige, individuals can maintain fitness without financial burden.

Avoiding the Next Big Trend Trap

Fitness trends come and go with remarkable speed—each promising faster results, better performance, or a revolutionary approach. From vibration plates to cryotherapy chambers, the market is full of innovations that capture attention but often fail to deliver lasting value. These trends thrive on novelty and celebrity endorsement, creating a sense of urgency that drives impulse purchases. Limited-time offers, exclusive access, and influencer promotions exploit the fear of missing out, leading people to spend before they fully understand what they’re buying. The result is often regret: unused equipment, canceled subscriptions, and wasted money.

To avoid this trap, a disciplined approach is essential. The first step is pausing before any purchase. Instead of reacting to an ad or social media post, take time to reflect. Ask: Has this been proven effective? Is it aligned with my goals? Will I use it consistently? Research is critical. Look for independent reviews, scientific studies, or testimonials from long-term users, not just promotional content. Many trends are backed by anecdotal evidence rather than rigorous testing. A program that worked for one person may not suit another’s lifestyle or physical condition.

Whenever possible, test before committing. Many gyms and studios offer trial classes. Digital platforms often have free versions or week-long trials. Use these opportunities to assess fit and comfort. If a program feels overwhelming, confusing, or unsustainable, it’s unlikely to last. Peer recommendations can also provide valuable insight. Talking to friends or community members who have tried a product or service offers real-world perspective beyond marketing claims. Delayed gratification is another powerful tool. Implement a 30-day waiting period for any fitness purchase over a certain amount. This simple rule allows emotions to settle and priorities to clarify. By the end of the month, the urge to buy often fades, revealing whether the desire was genuine or fleeting.

Turning Fitness Spending into Long-Term Financial Skill

Managing fitness expenses is more than a budgeting exercise—it’s a gateway to broader financial competence. The skills developed through this process—tracking, evaluating, prioritizing, and delaying gratification—apply to every area of personal finance. When someone learns to question the value of a $90 monthly barre class, they also become more mindful of other recurring charges, from streaming services to insurance plans. This heightened awareness fosters a proactive relationship with money, shifting from passive spending to intentional decision-making. Over time, these habits compound, leading to greater financial resilience and freedom.

Moreover, the discipline of aligning spending with actual use builds patience and self-trust. It reinforces the idea that long-term results come from consistency, not shortcuts. This mindset extends beyond fitness to savings goals, debt management, and retirement planning. Just as skipping workouts undermines progress, sporadic financial efforts yield limited results. Sustainable change requires routine, reflection, and adjustment. By mastering one category of spending, individuals gain confidence to tackle others. They begin to see money not as a source of stress, but as a tool for building the life they want.

In the end, the goal is not just physical health or financial savings, but integration—the harmony of well-being and wisdom. A balanced fitness routine supports energy, mood, and longevity. A balanced budget supports security, choice, and peace of mind. When these two forces work together, they create a foundation for a fulfilling life. The journey starts with a single audit, a single question: ‘Is this worth it?’ From there, every decision becomes an opportunity to grow stronger—not just in body, but in judgment, clarity, and control. That is the true measure of strength.